It is crucial to improve the financial regulatory system and strictly maintain the bottom line of low risks, China’s former finance minister said at a forum on Saturday in commenting on the recent collapse of the US Silicon Valley Bank (SVB) that sent shockwaves across the US banking system.

The SVB bankruptcy suggests that financial markets have been hit by monetary policy changes, Lou Jiwei, director general of the Global Asset Management Forum and China’s former finance minister, said at the ongoing annual session of the forum, according to media reports.

The unconventional monetary and fiscal policies adopted by some countries during the COVID-19 pandemic have led to high leverage ratios across governments, households, enterprises, and financial institutions. These ratios rose quickly but would not fall easily, Lou said.

It has exacerbated the hikes of the inflation and its impact has been extended to the global financial market, with soaring volatility in stocks, bonds, foreign exchange markets, Lou said, noting that from a historical perspective, it may lead to a new round of crisis spilling over into emerging markets.

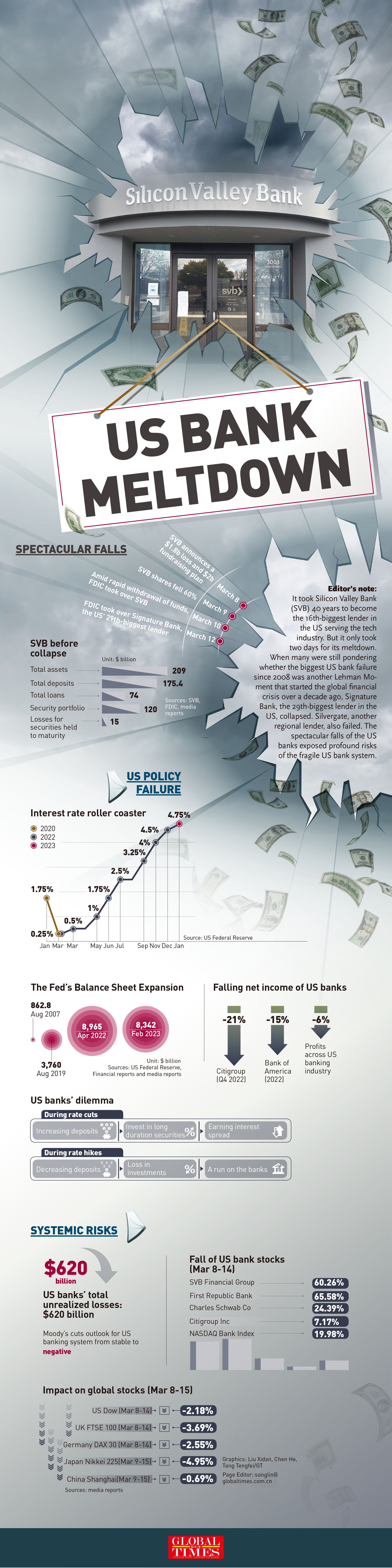

As the US 16th largest lender, SVB faced meltdown on March 10 after a 48-hour run on deposits. It marked the largest bank crash since the 2008 financial crisis. When many were still pondering whether it was another Lehman Moment that started the global financial crisis over a decade ago, the US 29th biggest lender Signature Bank closed by regulator just two days after the SVB collapse.

The unexpected bank failure has soon sent shockwaves across the US banking system, with jitters spreading across the global market.

NASDAQ Bank index, which contains securities of NASDAQ-listed banks, dropped 22 percent from 3981.59 on March 8 to 3100.16 on March 17. The First Republic Bank saw its share price plummeted from $115 to $23.03 during the period, down nearly 80 percent.

In Europe, alarms sounded at Credit Suisse, a 167-year-old Swiss bank which is also the 17th largest lender across Europe. Its share price has lost 30 percent since March 8. Although the bank secured a $54 billion loan from Swiss central bank to shore up its liquidity, its investor sentiment remains fragile.

The bank failure and emergency showed that the long-simmering profound financial risks in Europe and the US have reached a critical point of periodic outbreak, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times on Saturday.

Banks are professional risk managers, and if they cannot manage risk effectively, then it means that the risk control system has failed, Dong said.

SVB is not the only risk point, a total of 186 US banks have reportedly been exposed to similar risks. “Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billions of insured deposits at risk,” read an analysis conducted by New York-based Social Science Research Network.

Counting on its advantages as the world’s dominant financial power, US policymakers have believed that they could reap interests of others to plug their own loopholes. It is such “financial confidence” which has supported them to adopt a radical quantitative easing and then a drastic tapering policy, Dong said.

Yet, a considerable number of emerging countries are attaching more importance to financial risk management and firmly safeguarding their own autonomy, Dong said.

China has attached great importance to preventing and defusing systemic risks, and it is further improving its financial regulation including setting up a central commission for finance following the two sessions to optimize and adjust setting and functions of regulatory institutions, Lou said.

Lou said that China will continue to cooperate with other countries in financial regulation to jointly forestall and defuse systemic risks in the global financial system and maintain stability and prosperity of the global financial market.

The People’s Bank of China (PBC), the nation’s central bank, recently stressed the overall financial market is running smoothly and risks are under control. Large banks with excellent ratings are the “ballast stone” of China’s financial system. Reforms of a few problematic small and medium-sized financial institutions have achieved important progress, and illegal financial activities have been effectively curtailed, it said.

Amid a steep drop in the value of global banking shares following the SVB meltdown, however, Chinese banking shares rallied collectively. The Bank of China saw its share price surged from 3.33 yuan ($0.48) on March 8 to 3.48 yuan on March 17, reaching a five-year high.

The Chinese economy has contributed more than 30 percent of global growth annually for the past two decades, and this momentum will continue in the future, Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co, told the Global Times on Saturday.

Under such circumstances, China’s strong enterprises, robust core assets will remain very attractive to foreign investment, Yang said, predicting that it is highly likely that the inflow to China’s A-share market from overseas investor will exceed 300 billion yuan this year.

Source link

RELATED ARTICLES

Following the shockwaves from the collapse of Silicon Valley Bank (SVB) weighed on global bank stocks, China’s stock ...

Infographic: SVB meltdown exposes risks of fragile US bank system Infographic: GTSVB collapse highlights need to strictly maintain the bottom line of low risks

Infographic: SVB meltdown exposes risks of fragile US bank system Infographic: GTSVB collapse highlights need to strictly maintain the bottom line of low risks