THE collapse of four banks in the United States and Europe has sent fears of systemic risks throughout the global banking system.

Currently, the risk of contagion in Malaysia is low, given the limited direct and indirect exposure of the domestic banking system as well as the swift action taken by United States and Swiss regulators to contain their respective banking crises. Banks in Malaysia are also generally well-capitalised with healthy liquidity positions, underpinned by a stable and diversified funding base. Moreover, Bank Negara keeps a close watch on all banks operating locally as compared to the two-tier system in the United States, said RHB Banking Group regional sector head, group wholesale banking David Chong Voon Chee. The United States has a dual banking system, with national banks regulated on the federal level and state banks regulated by each state. Still, we should monitor for second and third order effects from these events, where possible cause-and-effects could lead to market volatility, tighter access to credit and ultimately, slower global growth. In the United States, Californiabased Silicon Valley Bank (SVB) and New York’s Signature Bank, collapsed due to heavy losses on their bond portfolios and a huge run on deposits. San Diego-based Silvergate Bank, which catered largely to cryptocurrency companies, had voluntarily wound down its operations. As investors began ditching out anything related to banking risks, Switzerland’s scandal-ridden Credit Suisse also collapsed as its largest shareholder, Saudi National Bank, stopped investing in it. As a result of the banking crisis in March, 2023, the jump in risk indicators – credit default swaps of major US and European banking names as well as US sovereign credit default swaps – has become worrying. However, their levels are still far from the highs of the global financial crisis of 2008. A credit default swap is a financial derivative that allows investors to offset their credit risks with that of another investor. But volatility outside of rates – in other asset classes like foreign exchange, equities and commodities – remain relatively modest by historical standards, implying that the crisis is not systemic, said United Overseas Bank in a report. In the case of Malaysian banks, beyond the minimum level of 8% for total capital ratio (TCR), excess capital stands at about Rm196bil, as of January. Meanwhile, TCR (the ratio of total capital to total risk-weighted assets) at 18.9% in January is way above the prescribed level of 8%. This means that banks have substantial buffer in their capital levels where they are able to absorb a significant amount of loans impairment and market volatility, said Bank Muamalat chief economist and social finance, Mohamed Afzanisam Abdul Rashid. Despite external uncertainties, this indicates that borrowing and lending activities can be conducted seamlessly, while households and businesses are able to access credit from the banking sector without hassle. Nevertheless, every financing application will be subjected to their eligible criteria including repayment history and the level of indebtedness. Malaysian banks also usually have a relatively smaller portion of assets in investments while interest rate increase is less drastic, and hence, the mark-to-market losses would be comparatively smaller, said Fortress Capital Asset Management Sdn Bhd CEO Thomas Yong. If a security was bought at a certain price and the market price dropped later, it would result in an unrealised loss, marking the security down to the new market price would lead to mark-to-market losses. Malaysian banks also have a large portion of household depositors, while business depositors are diversified across different industries. Hence, the need for a large amount of liquidity to fund withdrawals is less urgent. While there will be jitters, banks in Malaysia are well-regulated besides having a diversified depositor base, they also have retailers who are more loyal, said Etiqa Insurance and Takaful chief strategy officer Chris Eng. The funding base of the Malaysian banking system remained strong, with an aggregate liquidity coverage ratio (LCR) and net stable funding ratio of 154% and 118.2% respectively, at the end of 2022. The LCR seeks to ensure that banks hold sufficient high-quality assets, while the net stable funding ratio calculates the proportion of available over required stable funding. More than 80% of banks’ high quality liquid assets are in the form of placements with Bank Negara and government bonds, which banks can access and pledge in the interbank market or with Bank Negara for additional liquidity, according to Maybank Investment Bank in a report. Foreign currency external debt-at-risk was manageable, at Rm80.4bil or 20.3% of total banking system external debt. Loans under repayment assistance programmes declined to 4.2% of total banking system loans at the end of 2022, from 5.7% at the end of June, 2022. Loan loss coverage ratio (which indicates how protected a bank is against future losses), including regulatory reserves, remained high at 118.2% at the end of 2022. Since the Asian Financial Crisis in 1997, Malaysia’s banking industry has gone through a significant consolidation which brought down the number of banks from more than 60 to about 10 banks by early 2020. Non-performing loans had led to the creation of Danaharta Nasional to address non-performing accounts while banks concentrated on running their businesses. Risk management oversight was implemented at a robust pace and Malaysian banks were required to run multiple scenarios for the stress testing of their balance sheets. This resulted in well-capitalised and highly liquid banks as well as sound credit underwriting standards. Following the recent banking crisis, banks especially those in the United States and Europe, now need to defend and fight for their credit worthiness.While fears of contagion are being allayed for now, caution and constant monitoring will prevail.

Related posts:

SVB meltdown exposes risks of fragile US bank system, highlights need to strictly maintain the bottom line of low risks

CLICK TO ENLARGE “This is all part of a broader discussion of possibilities for reducing the use of the dollar. This discussion is not n..

US itself is accelerating the de-dollarization process De-Dollarization and the Fall of American Hegemony Ever since the Fed ended its ult...

Related news

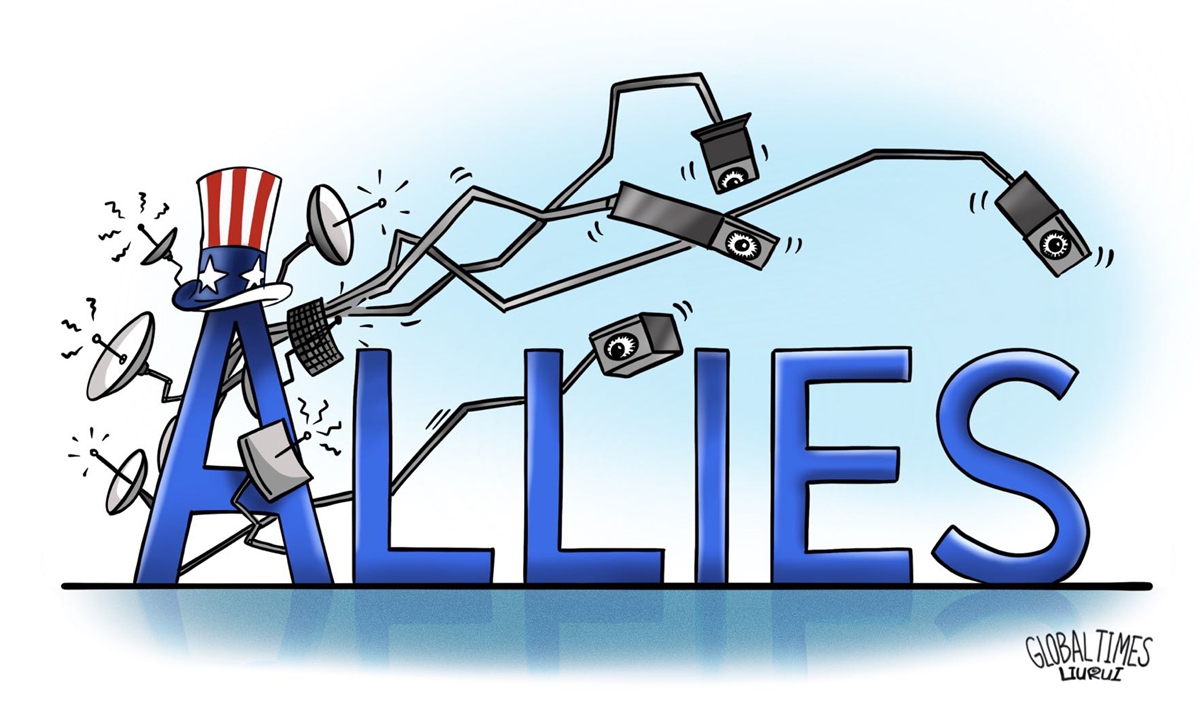

It's impossible for South Korea to enjoy being monitored: Global Times editorial

It's impossible for South Korea to enjoy being monitored: Global Times editorial

Facts repeatedly prove that the US, which believes in the principle of power, is not softer on its allies when it comes to using intelligence as a tool for blackmailing and coercion than it is toward a powerful "opponent."