THE Penang housing market moved sideways on both the primary and secondary markets in the first quarter of the year, says Michael Geh (pictured), director at Raine & Horne International Zaki + Partners.

THE Penang housing market moved sideways on both the primary and secondary markets in the first quarter of the year, says Michael Geh (pictured), director at Raine & Horne International Zaki + Partners.“I noted active transactions on the secondary market with prices staying flat,” he says in presenting the 1Q2016 Penang Housing Property Monitor.

Banks, he adds, only provide loans of up to 70% to 80% of a property’s value and serious first-time homebuyers have to make up the difference in order to sign the sales and purchase agreement.

Michael Geh“A few primary market projects have obtained the Advertising Permit and Developer Licence (APDL) and moved into the stage of processing loans from commercial banks and signing the S&P.” These projects include I-Santorini, SummerSkye and ForestVille, all under Ideal Group.

Will the prices of Penang houses, considered expensive, drop because of the soft market conditions? Geh says prices have come down to more realistic levels, especially with the government pushing the developers to build properties priced from RM300,000 to RM400,000 in the last two years, specifically for owner-occupiers.

Some of these properties, in areas such as Sungai Ara, Patani Road and Relau, have been taken up and are currently under construction, he adds.

Elsewhere in the country, some developers are pushing sales by providing financial assistance to the purchasers. Will those in Penang follow suit?

Geh says such a practice is not widespread for now. “Besides Sunway Bhd and S P Setia Bhd, I don’t see any other developer providing financial packages at the moment. I believe there are plans for such assistance but so far, nothing has been announced.”

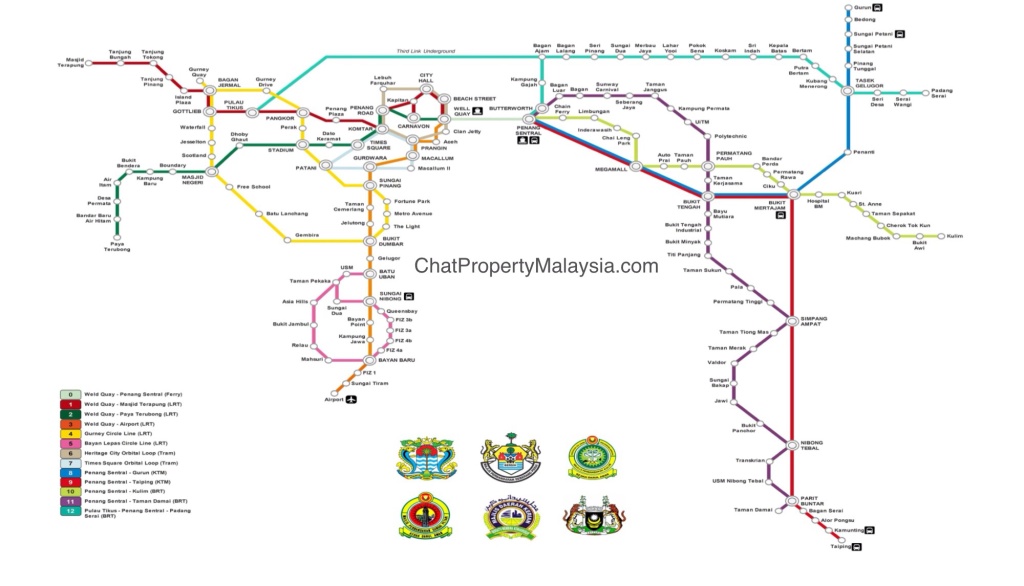

The TMP, he feels, will lead to equitable home property prices as areas that are not in prime locations will become more accessible, boosting demand for homes and resulting in higher prices. Properties in prime areas, which normally fetch higher prices, should see some price correction as demand is more evenly distributed across the state.

Apart from that, Geh opines that the TMP will help retain talent, which will subsequently impact the property market as the pool of workers seek to rent or own residential properties.

At present, two light rail transit lines have been approved under the TMP — one from Prangin Canal to Penang International Airport in Bayan Lepas and the other from Prangin Canal to Straits Quay.

“An industry that has been highlighted by the state is the knowledge economy, such as apps and animation,” Geh says. This has been identified as a key economic sector for the next decade.

There is a proposal for three reclaimed islands in the southern part of Penang island to locate businesses for this sector, he says, and for the islands to be connected by an LRT line that extends from Penang International Airport.

There is a proposal for three reclaimed islands in the southern part of Penang island to locate businesses for this sector, he says, and for the islands to be connected by an LRT line that extends from Penang International Airport.However, it has not been plain sailing for the TMP because one of its components — the Sky Cab or cable car system — has been rejected by the federal government. The 4.8km cable car system, according to the Penang government’s TMP website, was to have connected Butterworth on the mainland to Jelutong on the island. While this is a blow to the state government’s plans, Geh does not believe it will affect property prices.

“Cable car systems are generally more for tourists and not meant to move high volumes of people. I don’t think there will be a large negative impact on the property market. High-volume, high-frequency vessels that travel on water may be a better solution,” he says.

Another component of the TMP is an undersea tunnel linking the island with the mainland. However, further details are not forthcoming at present.

A development that will have an indirect impact on the Penang housing market is the much-debated Gurney Wharf. This 3km-long reclamation project lies just off the shores of popular tourist spot, Gurney Drive.

Geh believes this project has great potential to benefit the island. “I believe Gurney Wharf is an exciting development because it creates recreational activities for Gurney Drive. I think it is a boost to the area.”

The prices of landed properties did not rise much compared with those of high rises, the data compiled for the monitor reveals. This is due to “stagnation” as there were very few transactions during the quarter under review, compared with the high-rise sector where there was much more activity, Geh explains.

Nevertheless, property values have increased compared with a year ago.

For 1-storey terraced houses, some areas surveyed showed activity year on year but little movement quarter on quarter.

On the island, properties in Jelutong showed the highest price growth, rising 5.88% to RM900,000 from a year ago, followed by houses in Tanjung Bungah (up 5.26% to RM800,000). Houses in Sungai Dua, Sungai Ara and Bandar Bayan Baru saw slight price increases of 2.56%, 2.04% and 1.96% respectively while those in Green Lane and on the mainland saw no changes.

For 2-storey terraced houses, there was no activity q-o-q but prices rose y-o-y in some of the areas surveyed.

The prices of houses in Pulau Tikus rose 6.67% to RM1.6 million, followed by those in Sungai Ara (5.26% to RM1 million) and Sungai Nibong (4.55% to RM1.15 million). Prices remained unchanged in Green Lane and the mainland.

Semi-detached and detached houses

The 2-storey semidees in some areas saw more activity in 1Q2016 than in the previous quarter and last year. Prices in Sungai Dua and Minden Heights rose 6.67% to RM1.6 million q-o-q, followed by those in Sungai Nibong (up 5.71% to RM1.85 million) and Island Park (up 2.27% to RM2.25 million). Prices in Sungai Ara remained unchanged.

There was no q-o-q increase for 2-storey detached houses but 50% of the units surveyed in the monitor saw y-o-y activity.

Island Glades bungalows saw a 3.57% increase to RM2.9 million y-o-y , the prices of Green Lane houses rose 2.86% to RM3.6 million and Pulai Tikus houses were up 2% to RM5.1 million. House prices in Tanjung Tokong, Tanjung Bungah and Minden Heights remained unchanged.

Flats and condominiums

Three-bedroom flats in Green Lane and Bandar Baru Air Itam showed price increases q-o-q as well as y-o-y .

In Green Lane, prices rose 5.26% to RM400,000 q-o-q and 17.65% y-o-y. Units in Bandar Baru Air Itam rose 4.35% to RM240,000 q-o-q and 20% y-o-y.

Compared with a year ago, the prices of flats in Paya Terubong were up 12.5% to RM180,000, followed by Sungai Dua and Lip Sin Garden (6.06% to RM350,000) and Relau (3.45% to RM300,000).

Among the 3-bedroom condos, the biggest gainers were properties in Pulau Tikus, which rose 4.62% q-o-q and 9.68% y-o-y to RM680,000.

In Island Park and Island Glades, prices rose 4.17% q-o-q and 6.38% y-o-y to RM500,000 while condos in Batu Ferringhi rose 2.22% to RM460,000 q-o-q and y-o-y.

Batu Uban condos rose 5% to RM420,000 from the previous year but there was no activity q-o-q. The prices of Tanjung Bungah units remained unchanged.

By Wong King Wai The Edge Property

Soaring house prices worry Penangites below 30

GEORGE TOWN (June 21): Despite the affordable housing programme by the state government, Penangites, especially those below the age of 30, are worried that they are unable to own a house in the future.

This is because housing prices in Penang island have risen by about 50% for the last five years and even for houses that was built under the affordable housing project.

A Bernama survey showed that several affordable housing projects that were completed less than 10 years ago in Bandar Baru Air Itam was originally priced at about RM175,000 but currently being resold at RM300,000 and above.

State Housing, Local and Town and Country Planning Committee chairman Jagdeep Singh Deo, said the state government had no power to control the price of houses being sold by house owners.

At present the state government had set a moratorium of five years for affordable housing and 10 years for low cost housing before it could be sold in the open market.

"There's nothing that can be done by the state government to control the price but, what we can do is to provide more affordable housing so that the people can buy at a lower price," he said.

Muhamad Amir Amin, 26, who worked as a graphic designer, said he earned about RM2,300 per month and could not even able to buy a low cost house with that wage.

"A low cost house costs RM42,000, which I cannot even afford to buy and from my observation, there is no low cost housing in Penang any more.

"All are either low medium cost or affordable housing which cost RM75,000 and above," he said.

Universiti Sains Malaysia (USM) Social Science senior academician, Zainab Wahidin said that building more houses to tackle the increase of property price was not a solution given that Penang's land was limited, especially on the island.

"There must be a regulation to control the housing price as a house is a basic necessity. Everybody needs a house to live in," she added.

By Bernama

Related posts

No comments:

Post a Comment