China's economy is stable and on the rise.

During the ongoing 20th National Congress of the Communist Party of China (CPC), an official in charge of the National Development and Reform Commission said at a press conference that judging from the current situation, China's economy rebounded significantly in the third quarter, and from a global perspective, China's economic performance is still remarkable. Although affected by changes in the domestic and external environment, there are still some outstanding contradictions and problems in the current economic operation. However, China has a population of more than 1.4 billion and coupled with basic conditions such as a complete industrial system and a comprehensive industrial chain, "China's economic stabilization and improvement will be further consolidated." We have noticed that the assessments that some well-established international agencies made recently on China's economy coincide with China's own remarks. A well-known consulting agency said that most preliminary economic data indicated that China's economy recovered in the third quarter. Experts from the Economist Intelligence Unit also believe that compared with the economic difficulties of various countries in the world, "China has some unique advantages at the moment," which enables China's economy to maintain positive growth even when faced with great internal and external pressure. Of course, when people pay attention to and discuss China, there are also negative and pessimistic arguments, and some even regard China's development and security, government and market, openness and independence as contradictory to each other. Part of it comes from taking wishful thinking as fact, because it has long been "standard configurations" for some US and Western public opinion to downplay China; at the same time, part of it results from looking at "speed" with the outdated thinking and vision, without understanding the deep logic of China's high-quality development.If we observe the Chinese economy from the perspective of quality development, we will look through the complicated and indistinguishable superficial information to see the ongoing evolution and the improvement of the Chinese economy. In recent years, although the growth rate of China's economy has declined a bit compared with some periods in the past, its economic structure has been continuously optimized and its development momentum has been enhancing. In particular, the development speed of high-tech industries is equal to doubling the average development speed of the entire industry. Some major technological fields have made their ways to the global frontier, transformed by innovation-driven factors instead of the factors such as land, capital and labor in the past. At the same time, the energy consumption per unit of GDP has continued to decline. The sky is bluer, the mountains are greener, and the water is clearer. Although facing some temporary challenges and difficulties, China has enhanced its ability to overcome difficulties in its economy.

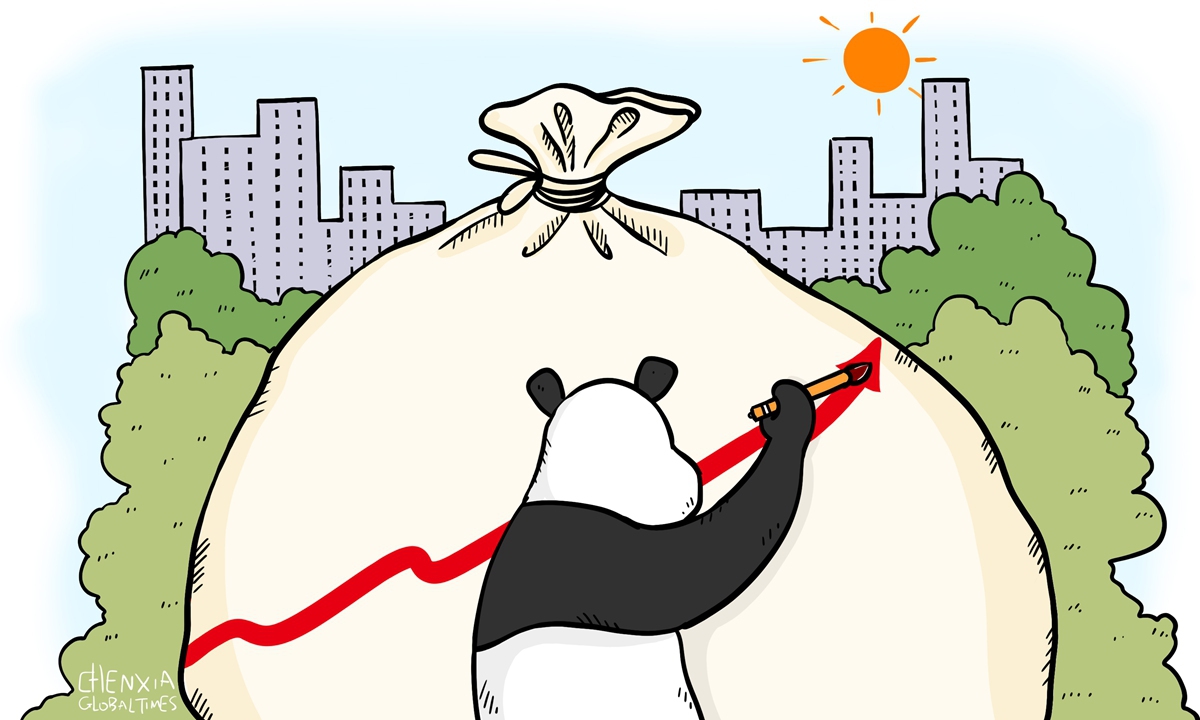

Illustration: Chen Xia/GT

The report to the 20th CPC National Congress stressed that "To build a modern socialist country in all respects, we must, first and foremost, pursue high-quality development." If the Chinese people are to live a better life and the Chinese nation is to realize its great rejuvenation, maintaining economic growth is of course very necessary. At the same time, the Chinese people have a broader and more comprehensive understanding of growth. And high-quality development is a new concept in which "innovation is the primary driver, coordination is an endogenous trait, eco-friendly growth prevails, openness to the world is the only way, and shared growth is the ultimate goal." This is also China's proactive pursuit of following the laws of economic development, adapting to changes in major social contradictions, and maintaining sustainable and sound economic development.

Compared with the past, China now puts more emphasis on maintaining national security, because the global security situation today has become more complicated, especially when the US is fanning flames and creating geopolitical crises everywhere and treating China as its No.1 strategic competitor. Against the backdrop of a sudden increase in external risks and a more insecure world, where can development come from without the overall favorable environment of national security? Some US and Western public opinions have deliberately put development on the opposite side of security, simply because in their hearts, they do not want China to be secure, nor do they want China to grow and develop. The giant ship of China has always pointed to a determined direction, never going off its course nor turning around. In the new era, the CPC, in accordance with the changes in reality at home and abroad, has taken precautions and foresight to extend and develop the experience summed up in the past decades, and then has established a new development concept and strategic plan, which is coherent and consistent with the past development direction. One thing that is absolutely certain is that China cannot copy the Western model for its development, and anyone expecting China to follow that path is bound to feel disappointed and will complain that "China has changed." But in fact it's not China that has changed. Instead, it is that they have made a wrong judgment from the very beginning; it can even be said that those who have been bad-mouthing China are disappointed, which just shows that China has done the right thing. Although China is already the second largest economy in the world, its per capita income is still far behind that of developed countries, which means greater economic growth space.Implementing the spirit of the report to the 20th CPC National Congress, insisting that development is the "first priority" and high-quality development as the "primary task," we have ample reasons to maintain confidence in the Chinese economy.

`

`