HOMESTAYS, once popular in rural areas, have now become big businesses in towns and cities nationwide.

Thousands of homeowners have discovered how to make money with their properties and avoid paying taxes.

They have joined global home-sharing marketplaces, and just like how Uber has made life for government-regulated taxi drivers difficult, the home-sharing phenomenon is shaving off hotel revenues.

By paying a mere 3% service fee per booking, homeowners – also called hosts – can connect with over 60 million travellers worldwide through online giants like American company Airbnb and Singapore-based HomeAway.

Airbnb’s website has a tool to help homeowners gauge their expected weekly income and according to this, the country’s chart-toppers are those in Langkawi who can make RM2,801 a week, followed by those around Malacca’s Jonker Walk (RM2,495 a week).

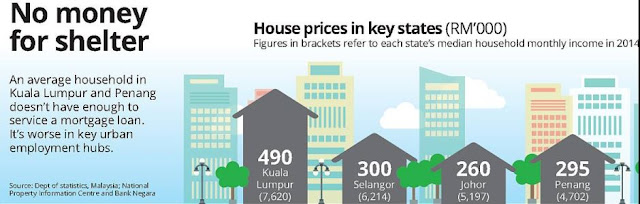

Close behind are Penang home-shares in Tanjung Tokong (RM2,494) and Pulau Tikus (RM2,449). In Bukit Bintang in Kuala Lumpur, they can expect to earn RM1,676 weekly, while those near Taman Pelangi in Johor Baru can expect RM2,287 a week.

The above estimated earnings are for apartments or houses catering to groups of five travellers.

There are homeshares even in the hinterlands. They can make an average of RM923 a week in Kota Baru, Kelantan. In Kangar, Perlis, homeshares can expect to collect RM1,619 a week.

Unlike hotel occupancies, the government has no knowledge nor way of tracking these check-ins.

All the payments are transacted via the home-sharing portals’ overseas payment gateways and the earnings are transferred to homeowners through international money wires, PayPal or direct deposits.

Their guests are also “exempted” from the RM2 per room per night heritage tax fee in Malacca and Penang’s local government fee of RM3 per room per night for four-star and five-star hotels, and RM2 per room per night for three stars and below.

“They don’t have to pay corporate or income taxes. They don’t need to collect GST or report their occupancy rates.

“They don’t need to install fire doors or water sprinkler systems. If this goes on, budget hotels can just take down their signboards and become home-share operators,” said Malaysia Budget Hotels Association president P.K. Leong.

He said his association had raised the issue of home-sharing with the government several times and urged them to regulate this business but no action had been taken.

“We estimate about 15% of our business is being siphoned into the home-sharing market. And it’s not really sharing,” he said.

“People are buying residential properties specifically to start short-term rental businesses. We believe this is growing at an alarming rate but we don’t have any way to track them.”

In 2014, Airbnb was reported to have over 800,000 listings worldwide. Now, the company declares on its website that it has over two million.

Five-star resorts contacted, however, do not feel threatened by the home-sharing operators.

Managers in two five-star hotels, who declined to be named, said these setups target budget travellers who come to Penang on business or already know what to do when they come to Penang.

“Our hotel offers a level of service not found in home-shares. It’s a different market,” said one manager. - By Arnold Loh The Star

Home-sharing services like Airbnb are becoming a hit among Malaysians. But hotels are urging the Government to regulate such services, claiming that rental of private apartments and studio units is illegal. Noting such calls, the Government is currently discussing how to address the matter.

LIVING rooms instead of hotel lobbies. Apartment units instead of hotel suites. This is the trend today.

More Malaysian holiday-makers are choosing to rent private properties as accommodation on their trips, instead of booking hotel rooms.

They do this using home-sharing services like Airbnb and Singapore-based HomeAway, which offer travellers the option to stay in a local host’s property.

They do this using home-sharing services like Airbnb and Singapore-based HomeAway, which offer travellers the option to stay in a local host’s property.

Ranging from single rooms to entire apartment units, guests can book their accommodation from hosts, who list their property on such websites to be leased out for a fee.

Sometimes, the fees are even lower than the room rates offered by hotels.

This is one of the factors that drive the popularity of such services, with the San Francisco-based Airbnb having over two million property listings for rent from local hosts in about 191 countries around the world.

In Malaysia, home-sharing services are also gaining traction among travellers and homeowners, who want to earn some income from offering short-term rentals.

However, the hotel industry in the country is claiming that such services are eating into their business, with some estimating about 5% to 15% of their business being diverted.

Hoteliers are also saying that consumers are not fully protected under such arrangements.

Likening home-sharing services like Airbnb to Uber in the taxi business, hoteliers claim that the hosts are not subjected to the same regulations imposed on hotels and do not need to pay taxes or collect the Goods and Services Tax (GST).

As the industry calls on the Government to regulate such services, the Tourism and Culture Ministry says discussions are ongoing to address the matter while the Urban Wellbeing, Housing and Local Government Ministry is open to feedback on the issue.

Malaysian Association of Hotels president Sam Cheah sees the growing popularity of such home-sharing platforms like Airbnb as a threat to the hotel industry.

“It isn’t a level playing ground because the hosts who are offering their properties for rent are not subjected to the same requirements, including safety standards,” he says.

Cheah points out that the hosts can afford to offer lower rates because their operating costs to run their businesses are smaller.

“They pay domestic usage for quit rent and utility bills. They are not required to adhere to safety requirements such as installing proper fire protection,” he adds.

Cheah explains that hotels also have public liability insurance and protect consumers in the event of negligence or fire.

“We are obligated to protect our customers. But there is no such policy for home-sharing hosts,” he says, urging consumers to be aware of such risks.

Cheah also points out that it is illegal for homeowners to operate a business for tourists and travellers when the property is meant for domestic dwelling.

“It is unfair for residents who are neighbours of such hosts as they will have strangers walking in and out of the premises,” he says.

These tourists will also be using the swimming pool, gym and other facilities meant for residents.

However, Cheah says the association, which consists of 881 member hotels, cannot discount or prevent such a business model from being practised.

“But the Government should regulate such businesses to protect tourists and make it an even playing field for hotel operators,” he says.

If left unchecked and unregulated, Cheah foresees the Government will have a problem dealing with the projected 36 million tourist arrivals by 2020.

“If we do not regulate Airbnb and other home-sharing services, we wouldn’t be able to monitor the industry. We wouldn’t know if we have an oversupply or over-development and businesses may lose out.

“It is just like Uber and GrabCar in the taxi industry. You cannot stop them but you have to regulate them. Then it makes sense,” he says.

Echoing Cheah’s call to the Government to impose regulations, Malaysian Association of Hotel Owners secretary Anthony Wong calls such home-sharing services illegal as hosts are not licensed to provide lodging and insurance for guests.

“It is amounting to making private arrangements and guests who are hurt during their stay are unable to claim insurance for any mishaps.

“As legal entities, hotels have permits to comply with. Our operating costs are expensive and we pay taxes,” says Wong, adding that hotel rates are also competitively priced.

He claims that the emergence of such services and illegal homestays have caused hoteliers to lose about 5% in revenue.

Acknowledging the concerns by hotels, Tourism and Culture Ministry secretary-general Tan Sri Dr Ong Hong Peng says the ministry has received complaints from the industry on the emergence of home-sharing platforms.

“This issue has been acknowledged and discussed extensively by the Special Task Force on Service Delivery and its working group.

“This working group is represented by government agencies such as the ministry, Malaysia Productivity Corporation, the Urban Wellbeing, Housing and Local Government Ministry and the police,” he tells Sunday Star.

Dr Ong adds that the question of regulating home-sharing platforms and conducting enforcement on homeowners under such services comes under the purview of local councils.

In the meantime, the ministry has its Malaysian Homestay Programme, which offers a unique experience to tourists.

“The programme enables tourists to stay and interact with local families who act as hosts.

“Under this programme, families and their houses register with the ministry after completing the homestay training module and following the guidelines,” he explains.

But Dr Ong points out that this is different from merely offering accommodation as it is a community-based tourism programme which offers tourists a lifestyle experience of rural villages.

In 2015, Malaysia attracted 25.7 million tourist arrivals, a decline of 6.3% compared to 27.4 million tourist arrivals in 2014.

For the first quarter of 2016, Malaysia registered an increase of 2.8% in tourist arrivals, which Dr Ong perceives as a positive outlook.

“A strong growth in arrivals is expected for the remainder of this year,” he says.

Former Urban Wellbeing, Housing and Local Government Minister Datuk Abdul Rahman Dahlan, who was just replaced in a Cabinet reshuffle on Monday, says it is still too early to decide whether to regulate homeowners involved in home-sharing services.

“This will require extensive discussion. The ministry welcomes feedback from stakeholders on this matter, including hoteliers, and will be more than happy to listen to their concerns,” he says.

The issue of regulating or even banning Airbnb and other home-sharing marketplaces is of growing concern.

Recently, it was reported that New York State in the United States may make it illegal to advertise apartments on Airbnb if a Bill is made into law by Governor Andrew Cuomo.

Meanwhile, the German capital of Berlin has stopped tourists from renting entire apartment units using Airbnb and other similar websites. The move bans homeowners from leasing their property to tourists without a city permit.

Japan released national guidelines for home-sharing services, making properties only available for rent if guests stay for a week or longer.

Other places are more receptive towards home-sharing platforms, including London, which amended housing legislation that makes it legal for locals to rent out their homes through websites like Airbnb. - By Yuen Meikeng The Star

AS more Malaysians open their homes to tourists, Airbnb describes Malaysia as an “exciting growth market”.

Nevertheless, the world’s leading community-driven hospitality company also encourages hosts to familiarise themselves with regulations in their area.

“These can differ from council to council and even street to street, all over the world,” Airbnb tells Sunday Star in an email.

Despite the growth of Airbnb across Malaysia, the company says the traditional hotel sector continues to do well too, with growth in occupancy and room rates.

“We’re proud of the economic benefits Airbnb provides to families, communities and local businesses that otherwise wouldn’t benefit from the tourist dollar,” it says.

Overwhelmingly, Airbnb says its hosts are renting out their homes occasionally, earning a little extra to help supplement their income.

“The vast majority of our hosts across Malaysia are everyday people renting their spare room or home occasionally, not commercial operators,” it adds.

Airbnb also says it has a good working relationship with the Malaysian Government and have partnered with it in the past.

In December last year, it was reported that a pilot project was being conducted in Malacca involving 130 homestays in 11 villages to help them market their business using online listings.

The programme was a collaboration between the Multimedia Development Corporation, the International Trade and Industry Ministry, the Tourism and Culture Ministry and Airbnb.

Airbnb says over 80 million guests have had a safe, positive experience using the platform.

“We help promote positive experiences through a global trust and safety team available 24/7, authentic reviews, verified profile information, and the $1 Million Host Guarantee,” it says.

A check on its website showed that the Host Guarantee will reimburse eligible hosts for damages up to A$1mil (RM3.06mil).

“The Host Guarantee should not be considered a replacement or stand-in for homeowners or renters insurance,” read the website.

Airbnb also has a refund policy for guests if the host fails to provide reasonable access to the booked listing, the listing booked is misrepresented or isn’t generally clean or unsafe, among others.

“Airbnb’s community operates on the principles of trust and respect. Our host and guest review systems demonstrate our commitment to responsible behaviour,” it says.

Meanwhile, some local Airbnb hosts in Malaysia have mixed views about the idea of having the Government regulate their business.

A full-time Airbnb host in Malacca, known only as Chen, says she welcomes such a move as long as it is done fairly and does not overly restrict the business.

“It can be beneficial for both the hosts and guests.

“If we are given licences by the Government, we can even put up signages to advertise our business. And for guests, they would have more protection,” says the 30-year-old lass who rents out one apartment and two townhouses.

Chen, a former marketing manager, quit her job two years ago to become a full-time Airbnb host, calling it her “interest and passion”.

She denies having any opposition from her neighbours in renting out her properties to tourists.

“I informed my neighbours before doing this. While they were initially doubtful, they are now happy I have guests,” Chen adds.

And in the event the Government decides to ban such services, Chen says hosts like herself will transform and adapt to the situation.

“This is the global trend and many are using this business model now. It is important to stay competitive and adapt to the times,” she says.

Another full-time host, Ridzuan Effendy, 29, hopes the Government does not impose regulations on Airbnb.

“Home-sharing services aren’t the same as hotels. Many tourists use Airbnb because the prices are cheaper compared to hotels.

“It is a case of having a willing buyer and seller. It shouldn’t be illegal,” says the former engineer, who lists his properties in Kuala Lumpur.

Unofficial hotel: At one time, nine of the 28 units of one of the blocks in Halaman Pulau Tikus were available for short-term rentals by medical tourists.>>>

Unofficial hotel: At one time, nine of the 28 units of one of the blocks in Halaman Pulau Tikus were available for short-term rentals by medical tourists.>>>

The key performance indicators for home-share operators are the guest reviews on their listings in global marketplaces like Airbnb and HomeAway.

“My guests and I review each other. It’s like Uber (global ride hailing app). You will know your guests’ reputation and your guests will also know yours.

“If anything bad happens, the guests or I can report it to Airbnb and we can be banned,” said an operator in Penang who only wants to be known as Sue, a housewife.

She rents out a house in Batu Ferringhi (RM320 a night) and a condominium unit in Pulau Tikus (RM400 a night) as a host on Airbnb and said her properties were now rated four-and-a-half stars.

The location may seem to be a secondary consideration, with one three-bedroom low-medium cost apartment in Air Itam having a five-star rating on Airbnb.

“It may look like a low-cost apartment from the outside and parking is limited. But it is lovely inside. Love the design and everything,” wrote a reviewer.

From the photos on this listing, the owner had decorated the place with a profusion of wallpaper and the furnishings and paintings within can rival a plush hotel room. There is bed space for up to eight guests and it is only RM150 a night.

But the surge of home-share operators may have inconvenienced neighbours.

Halaman Pulau Tikus management corporation chairman Khoo Boo Eng said his block in Lengkok Berjaya had become the haunt of medical tourists looking for a place to stay while seeking treatment here since several years ago.

He said he had seen medical tourists arrive who were truly sick.

“They shouldn’t be allowed to stay in our residential area. Some of my neighbours are worried that if they had contagious diseases, we would all be at risk,” he said.

He said at one time, nine out of 28 apartments in his block were rented out this way and many unit owners complained about the constant flow of strangers.

“Ours is a small, exclusive residence. We had to install extra security cameras and have a security guard 24 hours a day for our residents’ safety.

“They are making commercial use of their residential properties. We are planning to take them to court and seek injunctions to stop them from renting to short-stay guests,” he said.

Earlier in the week, officials from four departments of the Penang Island City Council (MBPP) carried out a spot check and four unit owners in Birch Regency Condominium in Datuk Keramat were fined RM250 each for operating a business without licence.

They knocked on the doors of 15 units believed to be available for rent on a short-term basis and found four being occupied – two units by Singaporeans, one by Australians and another by Canadians.

Tanjung MP Ng Wei Aik, who was present, said the officers spoke to the foreigners who confirmed they were here on holiday.

However, owners argued that there were no laws prohibiting them from renting out their units for any length of time.

One hurdle they had to go through is the complaints from other condo owners.

“We get many complaints from our fellow residents about these short-stay guests. We’re just doing our duty to maintain the peace in our condominium,” said a condominium committee member.

When contacted, Penang Island City Council Building Department director Yew Tung Seang said there could be a legal loophole that would make it hard for authorities to stop residential property owners from offering short-term rentals.

“Property owners have the right to earn rent and there is a grey area over short-term and long-term rentals.

“But when apartments or houses become like hotels, their operations can become a nuisance for neighbours.

“The council is planning a machinery to control this sort of activity,” he added.

In January, Johor Tourism, Trade and Consumerism committee chairman Datuk Tee Siew Kiong was reported as saying that homestay operators at housing estates in the urban areas in the state would no longer be allowed to use the word “homestay” to promote their accommodation.

He said there were plans to regulate and standardise the homestay segment in Johor.

He said many home owners in the urban areas had converted their properties into homestay facilities to cater to customers looking for a short stay.

In the United States’ New York State, legislators tabled a bill last month to ban the advertising of short-term home rentals of less than 30 days, with fines of up to US$7,500 (RM30,000).

“Every day I hear from New Yorkers who are sick and tired of living in buildings that have been turned into illegal hotels through Airbnb because so many units are rented out to tourists, not permanent residents,” Manhattan assembly-woman Linda Rosenthal was reported as saying last month.

It was reported that New York City has over 40,000 home-share listings and each earns an average of US$5,700 (RM23,300) a month.

I REFER to the reports “Home versus hotels” and “Travellers drawn to cheap prices” ( Sunday Star, July 3) and “Govern home-share under new laws” (see above).

It is well known that homestay is popular not only in Malaysia but also all over the world now. I have used both types of lodgings and find pros and cons in both.

Homestays are likened to the Airbnb concept which was launched in 2008 and has experienced rapid growth since then. Statistics show that at the end of 2015, Airbnb hosted eight million guests, chalked up three million nights of cumulative booking, were used by 50,000 renters per night and has a market capitalisation of US$2.5bil. This demonstrates the effectiveness and popularity of the concept used by Airbnb. However, in the US where this concept began, there is concern among the traditional hospitality industry that it is a threat to their business. There is pressure on the government to either put a stop to Airbnb activities or regulate them. According to a report commissioned by hotel associations in the US, some of the financial effects of Airbnb (focused in New York city but gives a strong indication of what may be happening in other parts of the world too) are:

i) Airbnb is growing because it is less labour intensive and requires lower level of service;

ii) There is no marginal cost for such services as new rooms can be added incrementally (or removed) and overheads are negligible compared to hotels;

iii) Hotels were losing revenue due to loss of room nights. This also had an ancillary effect on other services offered by the hotels such as F&B outlets and business centres; and

iv) Hotels in areas where Airbnb is established have responded to increased competition by reducing their prices.

I also looked up issues of competition in this market which may be a cause for concern. If we look at the homestay concept, what it offers is the opportunity for consumers on the supply side to supplement their income by providing a service via a peer-to-peer platform. It also offers travellers a chance to live like the locals and take part in cultural exchanges.

It is also basically a connection where supply meets demand and other needs such as budget constraints, personalised service, easy accessibility and homely atmosphere and all are rolled into one. Airbnb portrays itself as “a platform that allows the little guy to build up a complimentary industry, one that increases the size of the hospitality pie rather than take a slice from existing business.”

Applying this concept in Malaysia, it is a wonderful way to not only expand our hospitality industry especially in areas where hotel rooms are limited or extremely expensive but also allow locals to interact (people from the peninsula going to Sabah and Sarawak and vice versa, for example) or foreigners a chance to live like the locals.

This would in turn generate a multiplier effect on the local economy as other services such as restaurants, laundry, cleaning or transport would be required to support the homestay service. Besides all these, it would put money in the pockets of local residents and also support small businesses outside the hotel districts.

Will the homestay industry be a threat to the hotels? From a competition point of view, there may be some concerns (especially to budget hotels) but these could easily be overcome with careful formulation of policies and guidelines.

As consumer demand has shifted, the markets are or may be different, and it is ultimately up to the consumer to choose where he wants to stay.

Hotels are mainly located in the city or town centres and offer better services, amenities and standards. On the other hand, homestays and Airbnb serve up lodging options that cater to a more local and less touristy experience. Hotels and Airbnb/ homestays operate differently so there is room for both to coexist as long as they are after different customers.

Having said that, regulators and policy makers in Malaysia need to carefully study the implications of introducing regulations to homestay or Airbnb users from the supply side. Many countries have taken steps to address the issues emerging from the rapid rise of Airbnb and homestays. It would be useful for the Malaysia Competition Commission (MyCC) to commission a study on the effects of such concepts on the hospitality industry in Malaysia. This will then give the policy makers some empirical studies to formulate the required guidelines or regulations.

Competition is always threatened when there is a threat to the sharing economy (as in Uber versus the traditional taxi service). The sharing economy is where industry can collaboratively make use of under-utilised inventory via fee-based sharing. The market is always uncertain and nervous when a new marketplace is created, which in turn increases the difficulty of defining the market in competition law. The way businesses are being done and change in consumers’ tastes all merit a thorough study before any action is taken to manage a growing industry.

Two factors have arguable given rise to the rapid growth of peer-to-peer platforms – technology innovations and supply side flexibility. A win-win situation is always possible. If competition is distorted, as in when people buy into residential property to turn it into a business venture, that is when the authorities could step in.

By SHILA DORAI RAJ Founding and former CEO Malaysia Competition Commission

Related post:

Thousands of homeowners have discovered how to make money with their properties and avoid paying taxes.

They have joined global home-sharing marketplaces, and just like how Uber has made life for government-regulated taxi drivers difficult, the home-sharing phenomenon is shaving off hotel revenues.

By paying a mere 3% service fee per booking, homeowners – also called hosts – can connect with over 60 million travellers worldwide through online giants like American company Airbnb and Singapore-based HomeAway.

Airbnb’s website has a tool to help homeowners gauge their expected weekly income and according to this, the country’s chart-toppers are those in Langkawi who can make RM2,801 a week, followed by those around Malacca’s Jonker Walk (RM2,495 a week).

Close behind are Penang home-shares in Tanjung Tokong (RM2,494) and Pulau Tikus (RM2,449). In Bukit Bintang in Kuala Lumpur, they can expect to earn RM1,676 weekly, while those near Taman Pelangi in Johor Baru can expect RM2,287 a week.

The above estimated earnings are for apartments or houses catering to groups of five travellers.

There are homeshares even in the hinterlands. They can make an average of RM923 a week in Kota Baru, Kelantan. In Kangar, Perlis, homeshares can expect to collect RM1,619 a week.

Unlike hotel occupancies, the government has no knowledge nor way of tracking these check-ins.

All the payments are transacted via the home-sharing portals’ overseas payment gateways and the earnings are transferred to homeowners through international money wires, PayPal or direct deposits.

Their guests are also “exempted” from the RM2 per room per night heritage tax fee in Malacca and Penang’s local government fee of RM3 per room per night for four-star and five-star hotels, and RM2 per room per night for three stars and below.

“They don’t have to pay corporate or income taxes. They don’t need to collect GST or report their occupancy rates.

“They don’t need to install fire doors or water sprinkler systems. If this goes on, budget hotels can just take down their signboards and become home-share operators,” said Malaysia Budget Hotels Association president P.K. Leong.

He said his association had raised the issue of home-sharing with the government several times and urged them to regulate this business but no action had been taken.

“We estimate about 15% of our business is being siphoned into the home-sharing market. And it’s not really sharing,” he said.

“People are buying residential properties specifically to start short-term rental businesses. We believe this is growing at an alarming rate but we don’t have any way to track them.”

In 2014, Airbnb was reported to have over 800,000 listings worldwide. Now, the company declares on its website that it has over two million.

Five-star resorts contacted, however, do not feel threatened by the home-sharing operators.

Managers in two five-star hotels, who declined to be named, said these setups target budget travellers who come to Penang on business or already know what to do when they come to Penang.

“Our hotel offers a level of service not found in home-shares. It’s a different market,” said one manager. - By Arnold Loh The Star

Homes versus hotels

Home-sharing services like Airbnb are becoming a hit among Malaysians. But hotels are urging the Government to regulate such services, claiming that rental of private apartments and studio units is illegal. Noting such calls, the Government is currently discussing how to address the matter.

LIVING rooms instead of hotel lobbies. Apartment units instead of hotel suites. This is the trend today.

More Malaysian holiday-makers are choosing to rent private properties as accommodation on their trips, instead of booking hotel rooms.

They do this using home-sharing services like Airbnb and Singapore-based HomeAway, which offer travellers the option to stay in a local host’s property.

They do this using home-sharing services like Airbnb and Singapore-based HomeAway, which offer travellers the option to stay in a local host’s property. Ranging from single rooms to entire apartment units, guests can book their accommodation from hosts, who list their property on such websites to be leased out for a fee.

Sometimes, the fees are even lower than the room rates offered by hotels.

This is one of the factors that drive the popularity of such services, with the San Francisco-based Airbnb having over two million property listings for rent from local hosts in about 191 countries around the world.

In Malaysia, home-sharing services are also gaining traction among travellers and homeowners, who want to earn some income from offering short-term rentals.

However, the hotel industry in the country is claiming that such services are eating into their business, with some estimating about 5% to 15% of their business being diverted.

Hoteliers are also saying that consumers are not fully protected under such arrangements.

Likening home-sharing services like Airbnb to Uber in the taxi business, hoteliers claim that the hosts are not subjected to the same regulations imposed on hotels and do not need to pay taxes or collect the Goods and Services Tax (GST).

As the industry calls on the Government to regulate such services, the Tourism and Culture Ministry says discussions are ongoing to address the matter while the Urban Wellbeing, Housing and Local Government Ministry is open to feedback on the issue.

Malaysian Association of Hotels president Sam Cheah sees the growing popularity of such home-sharing platforms like Airbnb as a threat to the hotel industry.

“It isn’t a level playing ground because the hosts who are offering their properties for rent are not subjected to the same requirements, including safety standards,” he says.

Cheah points out that the hosts can afford to offer lower rates because their operating costs to run their businesses are smaller.

“They pay domestic usage for quit rent and utility bills. They are not required to adhere to safety requirements such as installing proper fire protection,” he adds.

Cheah explains that hotels also have public liability insurance and protect consumers in the event of negligence or fire.

“We are obligated to protect our customers. But there is no such policy for home-sharing hosts,” he says, urging consumers to be aware of such risks.

Cheah also points out that it is illegal for homeowners to operate a business for tourists and travellers when the property is meant for domestic dwelling.

“It is unfair for residents who are neighbours of such hosts as they will have strangers walking in and out of the premises,” he says.

These tourists will also be using the swimming pool, gym and other facilities meant for residents.

However, Cheah says the association, which consists of 881 member hotels, cannot discount or prevent such a business model from being practised.

“But the Government should regulate such businesses to protect tourists and make it an even playing field for hotel operators,” he says.

If left unchecked and unregulated, Cheah foresees the Government will have a problem dealing with the projected 36 million tourist arrivals by 2020.

“If we do not regulate Airbnb and other home-sharing services, we wouldn’t be able to monitor the industry. We wouldn’t know if we have an oversupply or over-development and businesses may lose out.

“It is just like Uber and GrabCar in the taxi industry. You cannot stop them but you have to regulate them. Then it makes sense,” he says.

Echoing Cheah’s call to the Government to impose regulations, Malaysian Association of Hotel Owners secretary Anthony Wong calls such home-sharing services illegal as hosts are not licensed to provide lodging and insurance for guests.

“It is amounting to making private arrangements and guests who are hurt during their stay are unable to claim insurance for any mishaps.

“As legal entities, hotels have permits to comply with. Our operating costs are expensive and we pay taxes,” says Wong, adding that hotel rates are also competitively priced.

He claims that the emergence of such services and illegal homestays have caused hoteliers to lose about 5% in revenue.

Acknowledging the concerns by hotels, Tourism and Culture Ministry secretary-general Tan Sri Dr Ong Hong Peng says the ministry has received complaints from the industry on the emergence of home-sharing platforms.

“This issue has been acknowledged and discussed extensively by the Special Task Force on Service Delivery and its working group.

“This working group is represented by government agencies such as the ministry, Malaysia Productivity Corporation, the Urban Wellbeing, Housing and Local Government Ministry and the police,” he tells Sunday Star.

Dr Ong adds that the question of regulating home-sharing platforms and conducting enforcement on homeowners under such services comes under the purview of local councils.

In the meantime, the ministry has its Malaysian Homestay Programme, which offers a unique experience to tourists.

“The programme enables tourists to stay and interact with local families who act as hosts.

“Under this programme, families and their houses register with the ministry after completing the homestay training module and following the guidelines,” he explains.

But Dr Ong points out that this is different from merely offering accommodation as it is a community-based tourism programme which offers tourists a lifestyle experience of rural villages.

In 2015, Malaysia attracted 25.7 million tourist arrivals, a decline of 6.3% compared to 27.4 million tourist arrivals in 2014.

For the first quarter of 2016, Malaysia registered an increase of 2.8% in tourist arrivals, which Dr Ong perceives as a positive outlook.

“A strong growth in arrivals is expected for the remainder of this year,” he says.

Former Urban Wellbeing, Housing and Local Government Minister Datuk Abdul Rahman Dahlan, who was just replaced in a Cabinet reshuffle on Monday, says it is still too early to decide whether to regulate homeowners involved in home-sharing services.

“This will require extensive discussion. The ministry welcomes feedback from stakeholders on this matter, including hoteliers, and will be more than happy to listen to their concerns,” he says.

The issue of regulating or even banning Airbnb and other home-sharing marketplaces is of growing concern.

Recently, it was reported that New York State in the United States may make it illegal to advertise apartments on Airbnb if a Bill is made into law by Governor Andrew Cuomo.

Meanwhile, the German capital of Berlin has stopped tourists from renting entire apartment units using Airbnb and other similar websites. The move bans homeowners from leasing their property to tourists without a city permit.

Japan released national guidelines for home-sharing services, making properties only available for rent if guests stay for a week or longer.

Other places are more receptive towards home-sharing platforms, including London, which amended housing legislation that makes it legal for locals to rent out their homes through websites like Airbnb. - By Yuen Meikeng The Star

Airbnb: Malaysia is a really ‘exciting growth market’

Airbnb: Malaysia is a really ‘exciting growth market’

AS more Malaysians open their homes to tourists, Airbnb describes Malaysia as an “exciting growth market”.

Nevertheless, the world’s leading community-driven hospitality company also encourages hosts to familiarise themselves with regulations in their area.

“These can differ from council to council and even street to street, all over the world,” Airbnb tells Sunday Star in an email.

Despite the growth of Airbnb across Malaysia, the company says the traditional hotel sector continues to do well too, with growth in occupancy and room rates.

“We’re proud of the economic benefits Airbnb provides to families, communities and local businesses that otherwise wouldn’t benefit from the tourist dollar,” it says.

Overwhelmingly, Airbnb says its hosts are renting out their homes occasionally, earning a little extra to help supplement their income.

“The vast majority of our hosts across Malaysia are everyday people renting their spare room or home occasionally, not commercial operators,” it adds.

Airbnb also says it has a good working relationship with the Malaysian Government and have partnered with it in the past.

In December last year, it was reported that a pilot project was being conducted in Malacca involving 130 homestays in 11 villages to help them market their business using online listings.

The programme was a collaboration between the Multimedia Development Corporation, the International Trade and Industry Ministry, the Tourism and Culture Ministry and Airbnb.

Airbnb says over 80 million guests have had a safe, positive experience using the platform.

“We help promote positive experiences through a global trust and safety team available 24/7, authentic reviews, verified profile information, and the $1 Million Host Guarantee,” it says.

A check on its website showed that the Host Guarantee will reimburse eligible hosts for damages up to A$1mil (RM3.06mil).

“The Host Guarantee should not be considered a replacement or stand-in for homeowners or renters insurance,” read the website.

Airbnb also has a refund policy for guests if the host fails to provide reasonable access to the booked listing, the listing booked is misrepresented or isn’t generally clean or unsafe, among others.

“Airbnb’s community operates on the principles of trust and respect. Our host and guest review systems demonstrate our commitment to responsible behaviour,” it says.

Meanwhile, some local Airbnb hosts in Malaysia have mixed views about the idea of having the Government regulate their business.

A full-time Airbnb host in Malacca, known only as Chen, says she welcomes such a move as long as it is done fairly and does not overly restrict the business.

“It can be beneficial for both the hosts and guests.

“If we are given licences by the Government, we can even put up signages to advertise our business. And for guests, they would have more protection,” says the 30-year-old lass who rents out one apartment and two townhouses.

Chen, a former marketing manager, quit her job two years ago to become a full-time Airbnb host, calling it her “interest and passion”.

She denies having any opposition from her neighbours in renting out her properties to tourists.

“I informed my neighbours before doing this. While they were initially doubtful, they are now happy I have guests,” Chen adds.

And in the event the Government decides to ban such services, Chen says hosts like herself will transform and adapt to the situation.

“This is the global trend and many are using this business model now. It is important to stay competitive and adapt to the times,” she says.

Another full-time host, Ridzuan Effendy, 29, hopes the Government does not impose regulations on Airbnb.

“Home-sharing services aren’t the same as hotels. Many tourists use Airbnb because the prices are cheaper compared to hotels.

“It is a case of having a willing buyer and seller. It shouldn’t be illegal,” says the former engineer, who lists his properties in Kuala Lumpur.

Related: Travellers drawn to cheap prices

Home-shares annoy neighbours

BE nice. Buy fruits for your guests or colouring books for their kids and potentially make RM8,000 or more each month renting your apartment or house to short-stay tourists.

The key performance indicators for home-share operators are the guest reviews on their listings in global marketplaces like Airbnb and HomeAway.

“My guests and I review each other. It’s like Uber (global ride hailing app). You will know your guests’ reputation and your guests will also know yours.

“If anything bad happens, the guests or I can report it to Airbnb and we can be banned,” said an operator in Penang who only wants to be known as Sue, a housewife.

She rents out a house in Batu Ferringhi (RM320 a night) and a condominium unit in Pulau Tikus (RM400 a night) as a host on Airbnb and said her properties were now rated four-and-a-half stars.

The location may seem to be a secondary consideration, with one three-bedroom low-medium cost apartment in Air Itam having a five-star rating on Airbnb.

“It may look like a low-cost apartment from the outside and parking is limited. But it is lovely inside. Love the design and everything,” wrote a reviewer.

From the photos on this listing, the owner had decorated the place with a profusion of wallpaper and the furnishings and paintings within can rival a plush hotel room. There is bed space for up to eight guests and it is only RM150 a night.

But the surge of home-share operators may have inconvenienced neighbours.

Halaman Pulau Tikus management corporation chairman Khoo Boo Eng said his block in Lengkok Berjaya had become the haunt of medical tourists looking for a place to stay while seeking treatment here since several years ago.

He said he had seen medical tourists arrive who were truly sick.

“They shouldn’t be allowed to stay in our residential area. Some of my neighbours are worried that if they had contagious diseases, we would all be at risk,” he said.

He said at one time, nine out of 28 apartments in his block were rented out this way and many unit owners complained about the constant flow of strangers.

“Ours is a small, exclusive residence. We had to install extra security cameras and have a security guard 24 hours a day for our residents’ safety.

“They are making commercial use of their residential properties. We are planning to take them to court and seek injunctions to stop them from renting to short-stay guests,” he said.

Earlier in the week, officials from four departments of the Penang Island City Council (MBPP) carried out a spot check and four unit owners in Birch Regency Condominium in Datuk Keramat were fined RM250 each for operating a business without licence.

They knocked on the doors of 15 units believed to be available for rent on a short-term basis and found four being occupied – two units by Singaporeans, one by Australians and another by Canadians.

Tanjung MP Ng Wei Aik, who was present, said the officers spoke to the foreigners who confirmed they were here on holiday.

However, owners argued that there were no laws prohibiting them from renting out their units for any length of time.

One hurdle they had to go through is the complaints from other condo owners.

“We get many complaints from our fellow residents about these short-stay guests. We’re just doing our duty to maintain the peace in our condominium,” said a condominium committee member.

When contacted, Penang Island City Council Building Department director Yew Tung Seang said there could be a legal loophole that would make it hard for authorities to stop residential property owners from offering short-term rentals.

“Property owners have the right to earn rent and there is a grey area over short-term and long-term rentals.

“But when apartments or houses become like hotels, their operations can become a nuisance for neighbours.

“The council is planning a machinery to control this sort of activity,” he added.

In January, Johor Tourism, Trade and Consumerism committee chairman Datuk Tee Siew Kiong was reported as saying that homestay operators at housing estates in the urban areas in the state would no longer be allowed to use the word “homestay” to promote their accommodation.

He said there were plans to regulate and standardise the homestay segment in Johor.

He said many home owners in the urban areas had converted their properties into homestay facilities to cater to customers looking for a short stay.

In the United States’ New York State, legislators tabled a bill last month to ban the advertising of short-term home rentals of less than 30 days, with fines of up to US$7,500 (RM30,000).

“Every day I hear from New Yorkers who are sick and tired of living in buildings that have been turned into illegal hotels through Airbnb because so many units are rented out to tourists, not permanent residents,” Manhattan assembly-woman Linda Rosenthal was reported as saying last month.

It was reported that New York City has over 40,000 home-share listings and each earns an average of US$5,700 (RM23,300) a month.

Study the homestay industry

I REFER to the reports “Home versus hotels” and “Travellers drawn to cheap prices” ( Sunday Star, July 3) and “Govern home-share under new laws” (see above).

It is well known that homestay is popular not only in Malaysia but also all over the world now. I have used both types of lodgings and find pros and cons in both.

Homestays are likened to the Airbnb concept which was launched in 2008 and has experienced rapid growth since then. Statistics show that at the end of 2015, Airbnb hosted eight million guests, chalked up three million nights of cumulative booking, were used by 50,000 renters per night and has a market capitalisation of US$2.5bil. This demonstrates the effectiveness and popularity of the concept used by Airbnb. However, in the US where this concept began, there is concern among the traditional hospitality industry that it is a threat to their business. There is pressure on the government to either put a stop to Airbnb activities or regulate them. According to a report commissioned by hotel associations in the US, some of the financial effects of Airbnb (focused in New York city but gives a strong indication of what may be happening in other parts of the world too) are:

i) Airbnb is growing because it is less labour intensive and requires lower level of service;

ii) There is no marginal cost for such services as new rooms can be added incrementally (or removed) and overheads are negligible compared to hotels;

iii) Hotels were losing revenue due to loss of room nights. This also had an ancillary effect on other services offered by the hotels such as F&B outlets and business centres; and

iv) Hotels in areas where Airbnb is established have responded to increased competition by reducing their prices.

I also looked up issues of competition in this market which may be a cause for concern. If we look at the homestay concept, what it offers is the opportunity for consumers on the supply side to supplement their income by providing a service via a peer-to-peer platform. It also offers travellers a chance to live like the locals and take part in cultural exchanges.

It is also basically a connection where supply meets demand and other needs such as budget constraints, personalised service, easy accessibility and homely atmosphere and all are rolled into one. Airbnb portrays itself as “a platform that allows the little guy to build up a complimentary industry, one that increases the size of the hospitality pie rather than take a slice from existing business.”

Applying this concept in Malaysia, it is a wonderful way to not only expand our hospitality industry especially in areas where hotel rooms are limited or extremely expensive but also allow locals to interact (people from the peninsula going to Sabah and Sarawak and vice versa, for example) or foreigners a chance to live like the locals.

This would in turn generate a multiplier effect on the local economy as other services such as restaurants, laundry, cleaning or transport would be required to support the homestay service. Besides all these, it would put money in the pockets of local residents and also support small businesses outside the hotel districts.

Will the homestay industry be a threat to the hotels? From a competition point of view, there may be some concerns (especially to budget hotels) but these could easily be overcome with careful formulation of policies and guidelines.

As consumer demand has shifted, the markets are or may be different, and it is ultimately up to the consumer to choose where he wants to stay.

Hotels are mainly located in the city or town centres and offer better services, amenities and standards. On the other hand, homestays and Airbnb serve up lodging options that cater to a more local and less touristy experience. Hotels and Airbnb/ homestays operate differently so there is room for both to coexist as long as they are after different customers.

Having said that, regulators and policy makers in Malaysia need to carefully study the implications of introducing regulations to homestay or Airbnb users from the supply side. Many countries have taken steps to address the issues emerging from the rapid rise of Airbnb and homestays. It would be useful for the Malaysia Competition Commission (MyCC) to commission a study on the effects of such concepts on the hospitality industry in Malaysia. This will then give the policy makers some empirical studies to formulate the required guidelines or regulations.

Competition is always threatened when there is a threat to the sharing economy (as in Uber versus the traditional taxi service). The sharing economy is where industry can collaboratively make use of under-utilised inventory via fee-based sharing. The market is always uncertain and nervous when a new marketplace is created, which in turn increases the difficulty of defining the market in competition law. The way businesses are being done and change in consumers’ tastes all merit a thorough study before any action is taken to manage a growing industry.

Two factors have arguable given rise to the rapid growth of peer-to-peer platforms – technology innovations and supply side flexibility. A win-win situation is always possible. If competition is distorted, as in when people buy into residential property to turn it into a business venture, that is when the authorities could step in.

By SHILA DORAI RAJ Founding and former CEO Malaysia Competition Commission

Related post:

While young adults all over the world are renting homes, Malaysias

prefer to own homes as soon as they get their first pay cheque.

Instea...