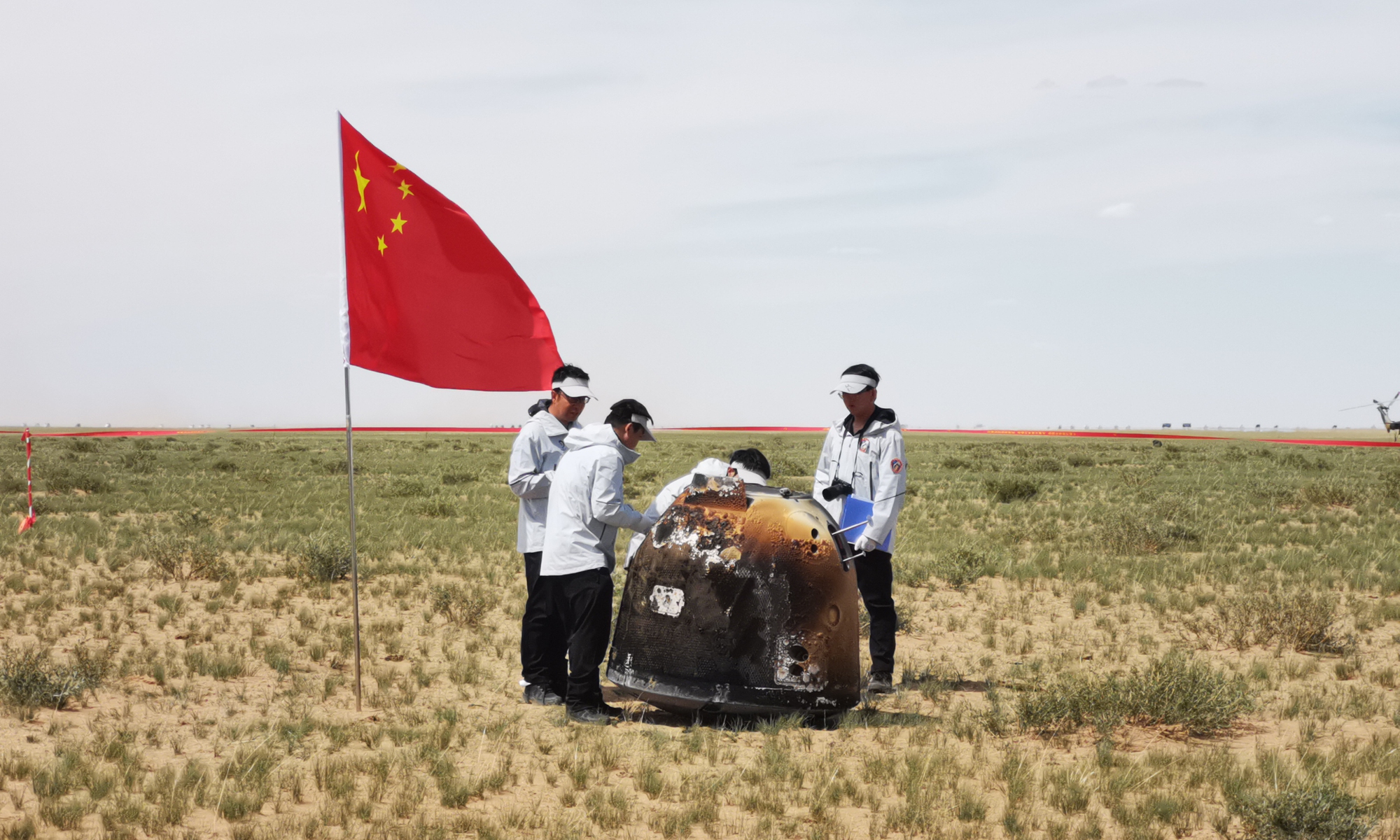

Photo: Wang Sijiang

Chang'e-6 - China's latest leap of moon exploration - has claimed full success, as the returning capsule of the craft, carrying the first batch of lunar samples collected from the far side of the moon in human history, safely touched down in designated landing site in the Siziwang Banner, in North China's Inner Mongolia Autonomous Region on Tuesday afternoon at 2:07 pm.Chinese President Xi Jinping on Tuesday extended congratulations on the complete success of the Chang'e-6 mission that brought back the world's first samples collected from the moon's far side. It marks "another landmark achievement in China's endeavor to become a space and sci-tech power," Xi noted.

In the congratulatory letter, Xi also stressed the hope to strengthen international exchange and cooperation in carrying out major aerospace engineering projects including deep-space explorations.

According to the China National Space Administration (CNSA), as planned, after the necessary ground processing work is completed, the recovered Chang'e-6 returner will be airlifted to Beijing, where the sample containers and payload will be extracted. The CNSA will hold a handover ceremony at an appropriate time to officially transfer the lunar samples to the ground application system. Subsequently, the samples will undergo storage, analysis and related research work.

After successfully completing the Chang'e-6 mission, the Queqiao-2 relay satellite will carry out scientific exploration missions at an appropriate time. It will use its onboard instruments, including an extreme ultraviolet camera, an arrayed neutral atom imager, and an Earth-Moon Very Long Baseline Interferometry (VLBI) experiment system, to collect scientific data from the moon and deep space, the CNSA said in a statement sent to the Global Times.

Stargazers from all over the world have paid close attention to the 53 day-long round trip of Chang'e-6, and applauded Tuesday for the unprecedented feat of it retrieving precious lunar samples from the far side of the moon, while suggesting that these samples would not only help enhance the humanity's understanding of the Earth's natural satellite but also create new opportunities for international cooperation in space studies, including those with the US.

"I do think a successful conclusion to this very complex mission [Chang'e-6] will show that Chang'e-5 was not just a fluke, and that Chinese space engineers really have mastered the challenges of carrying out these very difficult missions far from Earth, it's a real step forward in the maturity of the Chinese space effort," Jonathan McDowell, an astronomer from the Harvard-Smithsonian Center for Astrophysics in the US, told the Global Times on Tuesday.

"The successful execution of the Chang'e-6 mission has achieved breakthroughs in key technologies such as retrograde lunar orbit design and control, rapid intelligent sampling on the lunar far side, and ascent from the lunar far side. These technological advancements lay a foundation for future deep space exploration missions," Kang Guohua, a professor of Aerospace Engineering at Nanjing University of Aeronautics and Astronautics, told the Global Times on Tuesday.

The mission not only sets a new record for China's lunar exploration program but also has a profound impact on the global aerospace field. Through the Chang'e-6 mission, China has demonstrated its leadership and influence in space exploration, Kang said noting that lunar soil from the far side of the moon holds immense value for scientific research and deep space exploration due to its uniqueness.

Since no human probe has directly landed on and sampled from the far side, the soil from this area offers a distinct perspective. The South Pole-Aitken Basin is the oldest and deepest large impact basin on the moon, and samples from here can help scientists study the moon's origin and evolution more deeply, potentially providing critical clues about the formation and evolution of the solar system, he said.

Potential of intl collaboration in space

This year marks the 20th anniversary of China's lunar exploration program. China stands ready to continue working with like-minded international partners to explore humanity's common domain of the outer space, realize the shared dream of people around the world to discover more about the moon, and strive to advance the world's common endeavor of peacefully using the outer space, Chinese Foreign Ministry Spokesperson Mao Ning said on Tuesday, commenting on Chang'e-6's success.

The Chang'e-6 mission hosted four international payloads to the moon, including the European Space Agency (ESA)'s lunar surface ion composition analyzer, France's radon detection instrument, Italy's laser corner reflector, and a CubeSat from Pakistan, the CNSA revealed to the Global Times.

Pakistan's CubeSat, the country's inaugural lunar satellite, has sent back the first images it captured on May 10. It also achieved its goal of "successful separation and obtaining telemetry," marking the smooth completion of Pakistan's first-ever lunar project.

ESA's lunar surface ion composition analyzer, jointly developed with the National Space Science Center of the Chinese Academy of Sciences, successfully completed seven scientific detections after it started up on June 2, with the total detection time exceeding 3 hours, thus achieving the scheduled goal of detecting the lunar surface for at least 1 hour. This payload conducted negative ion detection on the lunar surface for the first time internationally, and the joint team is currently conducting scientific data analysis.

For the French payload, Philippe Baptiste, chairman of the French National Center for Space Studies, said it would still take some time to get all the data, but they are looking forward to it, as "the last time France was on the moon with an active instrument, it was in 1970," Baptiste was quoted as saying in a CGTN report.

The Chang'e-6 mission and its collection of precious samples from the far side of the moon will create more opportunities for cooperation between China and Western countries in space, according to space observers. And it is highly likely that NASA would again greenlight its researchers to access to these precious samples retrieved by the Chang'e-6 mission, however, the difficulties still lie in the US' domestic legal barriers, they said.

McDowell said he would be happy to see sharing of data between China and the US. The US space observer pointed out however that "the political winds here in the US are still strongly against allowing any large-scale cooperation."

In a November 29 statement, NASA said it has certified its intent to the US Congress to "allow NASA-funded researchers to apply to the China National Space Administration for access to lunar samples returned to Earth on the Chang'e 5 mission." However, NASA made it clear that this allowance applies specifically to Chang'e 5 mission samples and "the normal prohibition on bilateral activity with (the) PRC (People's Republic of China) on NASA-funded projects remains in place."

Chinese Foreign Ministry spokesperson Mao Ning told the Global Times on June 7 at a regular press conference that China is always open toward space exchanges and cooperation with the US. There are, however, difficulties in China-US space cooperation at the moment, which are caused by US domestic legislation such as the Wolf Amendment that prevents normal exchanges and dialogue between Chinese and US space agencies, Mao said.

In a rarely seen friendly move, NASA Administrator Bill Nelson reportedly sent congratulations to China over the Chinese spacecraft's landing on the lunar surface earlier this month, saying he was impressed with its fourth successful moon landing, the Washington Post reported on US local time Monday.

"I've been fairly pointed in my comments that we're in a space race with the Chinese, and that they are very good," he said in a recent interview with The Washington Post. "Especially in the last 10 years, they've had a lot of success. They usually say what they mean, and they execute on what they say."

However, the China space hawk continued its narrative of creating a new space race with China, by claiming that despite China's many achievements in space - which include an occupied space station in low Earth orbit and landing a rover on Mars in 2021 - the US remains on track to return astronauts to the lunar surface ahead of its chief rival, according to the report.

In a key step toward that goal, NASA intends to fly four astronauts around the moon late next year, and then land people on the surface in late 2026 for the first time since the last of the Apollo missions, in 1972.

Despite competition between the US and China, the two countries will have to find a way to coexist on and around the moon, Nelson was quoted as saying.